Stamp Duty Holiday Comes to an End

After 15 months, the end of the stamp duty holiday has finally arrived.

First implemented in July 2021, the UK stamp duty holiday officially ended as of October 1.

Now, home buyers will start paying stamp duty land tax on properties worth over £125,000.

But what does this mean for the UK property market?

Well, this isn’t the first time the holiday has “ended” with initial savings already rolled back in June 2021.

Due to this, we can now help predict what might happen to UK house prices and the overall market following the final stamp duty deadline.

With this in mind, the following post will discuss the end of the stamp duty holiday and analyse house prices after the stamp duty holiday.

Keep reading to learn more…

How to Build a Property Portfolio, Get Started Now!

Tips on how to start building your property portfolio with tools for success.

What is Stamp Duty and How Does it Work?

Stamp duty is a tax paid on the purchase of a property in England and Northern Ireland. There’s a similar system in Scotland and Wales, but tax rates vary in both locations.

The tax is paid within 14 days of a property purchase and operates under a progressive tax system.

This means that instead of paying a fixed tax rate, buyers will pay differing rates on a portion of the price.

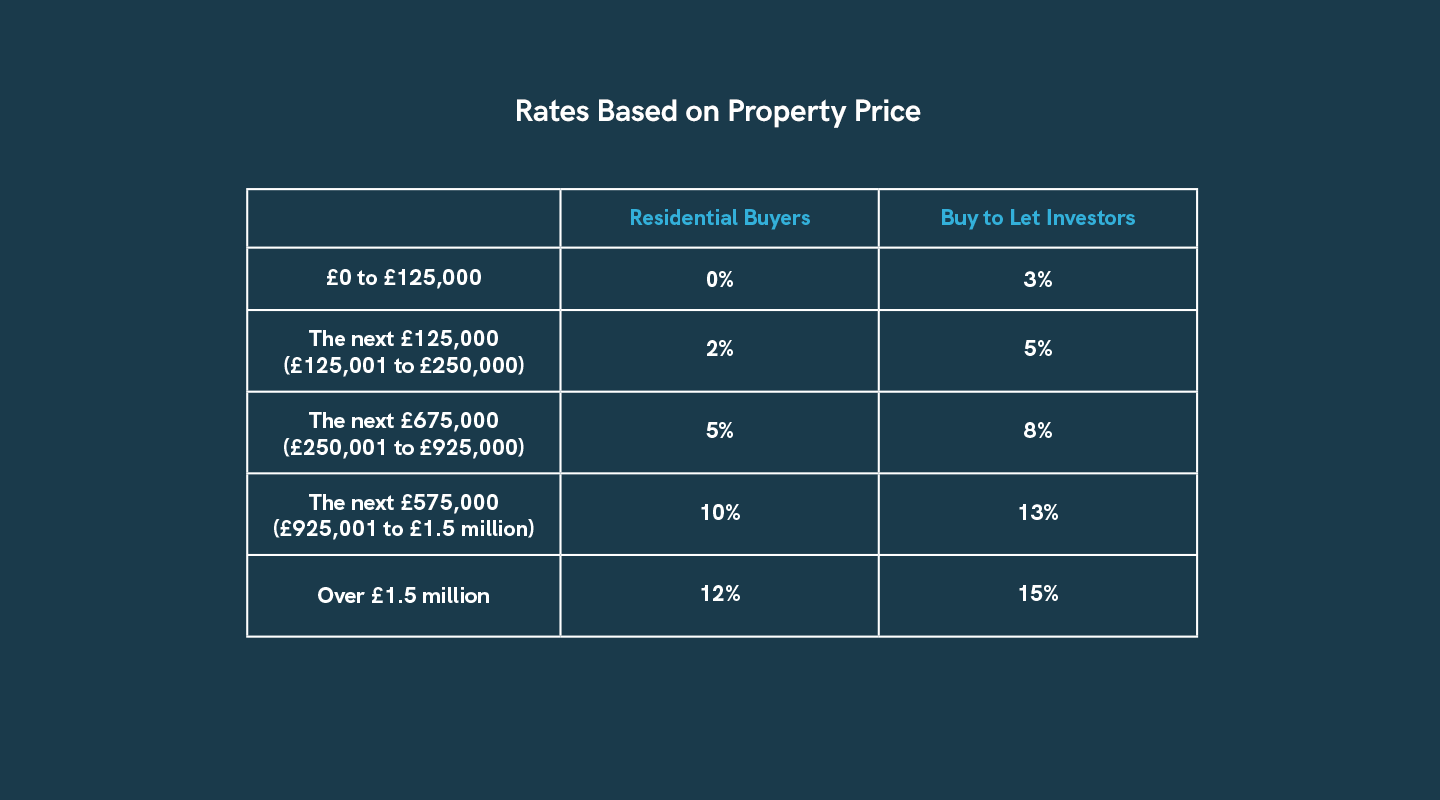

The current rates in England and Northern Ireland are as follows:

In laymen’s terms, buyers will only pay the tax on the money that exceeds the threshold.

For example, let’s say you’re a buy to let investor buying a home priced at £350,000.

You would first pay a 3% charge on the first £125,000, a 5% charge on the following £125,000, and an 8% charge on the final £100,000.

This means you would pay an overall charge of £18,000 in stamp duty.

You can calculate the latest stamp duty rates using our stamp duty calculator 2021.

Rates are slightly different for first-time buyers, with the threshold starting at £300,000.

To learn more, check out our ultimate stamp duty guide for first-time buyers.

Last Chance to Invest in Luxury Waterfront Apartments

Limited time offer! Back-to-market 1-bed units in one of our best-ever developments

What is the Stamp Duty Holiday?

The stamp duty holiday was a tax break first introduced in July 2020.

Designed to help promote property market activity and help buyers struggling financially from the Covid-19 pandemic, the stamp duty holiday saw the threshold at which buyers start paying taxes increased.

Initially set to last until March 31, 2021, the first stamp duty holiday helped save up to £15,000, with buyers not paying stamp duty on property worth up to £500,000.

This holiday was extended until June 30, 2021, with reduced savings available from July 1 to September 31, 2021, where the threshold was changed to £250,000.

Unbeatable Views, Unbeatable Returns

Secure a 2-bed apartment in this landmark development boasting panoramic views of Liverpool’s Waterfront.

When Does the Stamp Duty Holiday End?

So, what is the stamp duty holiday end date and the stamp duty deadline?

The official Stamp Duty holiday end date was June 30, 2021, after previously being extended from March 31, 2021.

However, there were reduced stamp duty tax rates available from July 1 to September 31, 2021, where buyers started paying stamp duty for properties worth over £250,000.

This means that the end of the stamp duty holiday was officially September 31, 2021, with normal pre-pandemic rates resuming as of October 1, 2021.

Get Your FREE Liverpool Investment Guide

Everything you need to know about investing in Liverpool, one of the UK’s hottest investment cities.

How Are House Prices After Stamp Duty Holiday Performing?

The stamp duty holiday had a huge impact on the UK property market.

With savings up to £15,000 available and a newfound appetite to move homes post-lockdown, the UK housing market experienced an historical rise in house prices.

UK house prices surpassed an average of £250,000 for the first time ever, with property prices rising at the fastest rate since 2004.

Between July 2020 and July 2021, UK property prices increased by a whopping 7.96%, according to official Land Registry data.

There was a consistent and considerable rise in house prices during the Stamp Duty holiday, peaking in June 2021 at over £265k – a record-high for Land Registry data.

This peak coincided with a record number of UK house sales, with The Guardian reporting over 213,000 sales recorded with HMRC in June.

While market activity dropped following the holiday in July 2021, with market activity dropping by a reported two-thirds, property prices and sale activity are already back on the rise in October 2021.

Following the stamp duty holiday end date and the end of the stamp duty holiday, a report from Rightmove in September 2021 has found that average property prices are now at an all-time high of £338,462.

And with Zoopla reporting that the market won’t lose momentum in 2021, it’s clear that house prices after the stamp duty holiday will only continue to rise.

Predictions from Savills have estimated that property prices are set to grow nationally by 6.2% by 2027, showing that the end of the stamp duty holiday has done little to curb the enormous growth seen in the property market over the last five years.

To learn more about buying property after the stamp duty deadline, be sure to check out our in-depth guides to stamp duty on our website.

If you want to learn more about property, you can check out all the latest buy to let news with RWinvest on our homepage.

For the latest on the UK property market, take a look at our updated Buy-to-Let Stamp Duty 2024 guide.